DeFi Vaults Issue #38

DeFi Market Research | Optimism continues its L2 conquest, Solana goes BRR, Plus: Thena Fi/Liquid Driver cross-chain flywheel, and more | NFA

⚡️What’s new?⚡️

🏦 This Week’s DeFi Vaults: Liquid Staked Vaults, and Stablecoins

📊Charts & Stats: Optimism continues its conquest of the L2 market and Solana goes BRRR

🧪 Yield Farming 101: Simple ETH auto-compounding strategy

📖 Thena fi, Liquid Driver, and the cross-chain flywheel

🐦 Last Week in Crypto Twitter (CT): Uniswap V3 analysis, Top Arbitrum protocols, and more

🗞 Latest News: Russia and Iran explore the launch of joint cryptocurrency backed by gold, Polygon hard fork, Cardano side-chains and more

🏦 This Week’s DeFi Vaults

Liquid Staked Vaults

sFTMx — ~9% ⬇️ (Reaper.Farm)

stMATIC-MATIC LP — ~8% ⬇️ (Beefy.Finance)

mSOL — ~8% ⬆️ (Marinade.Finance)

sAVAX— ~7% (BENQI)

frxETH— ~6% ⬇️ (Frax Finance)

Stablecoin Vaults

Ethereum

$USDC/$EURs — ~13% (Convex Finance)

$FRAX/$USDC — ~14% (Uniswap)

$USDC — ~9% ⬆️ (Maple)

Fantom

$MAI/$fUDST/$USDC— ~9% (Beefy.Finance)

$FRAX/$USDC — ~10% ⬆️ (Beefy.Finance)

$USDT — ~23% ⬆️ (cBridge)

$USDC — ~8% ⬇️ (Tarot)

Polygon

$USDC/$EURS — ~15% ⬇️ (Uniswap)

$MAI/$USDC — ~6% ⬆️ (Beefy.Finance)

$USDC— ~4% (Beefy.Finance)

Solana

$USDH — ~27% ⬆️ (Hubble protocol)

$USDT — ~7.8% ⬆️ (Solend.fi) | Stable pool

Optimism

$MIM/$USDC — ~12% (Beefy.Finance)

$FRAX/$USDC — ~9% (Beefy.Finance)

$USDT/$USDC — ~8% (Beefy.Finance)

Avalanche

$BUSD — ~7% ⬇️ (Vector)

$USDT.e/$USDC — ~9% ⬆️ (Trader Joe)

$USDT — ~6% (Vector)

Arbitrum

$DAI— ~59% 🔥(Reaper farm)

$MIM/$USDC — ~13% (Beefy.Finance)

$MAI/$USDC — ~11% (Beefy.Finance)

$DAI/$USDT — ~10% (Uniswap)

📊Charts & Stats

Optimism continues its conquest of the L2 market

Optimism is experiencing heavy stable coin inflows which can be seen as “New Money“ entering the blockchain:

Optimism’s total TVL tells a similar story:

Additionally, Optimism is constantly gaining more L2 market share at a faster rate than Arbitrum. Will Optimism overtake Arbitrum in TVL?:

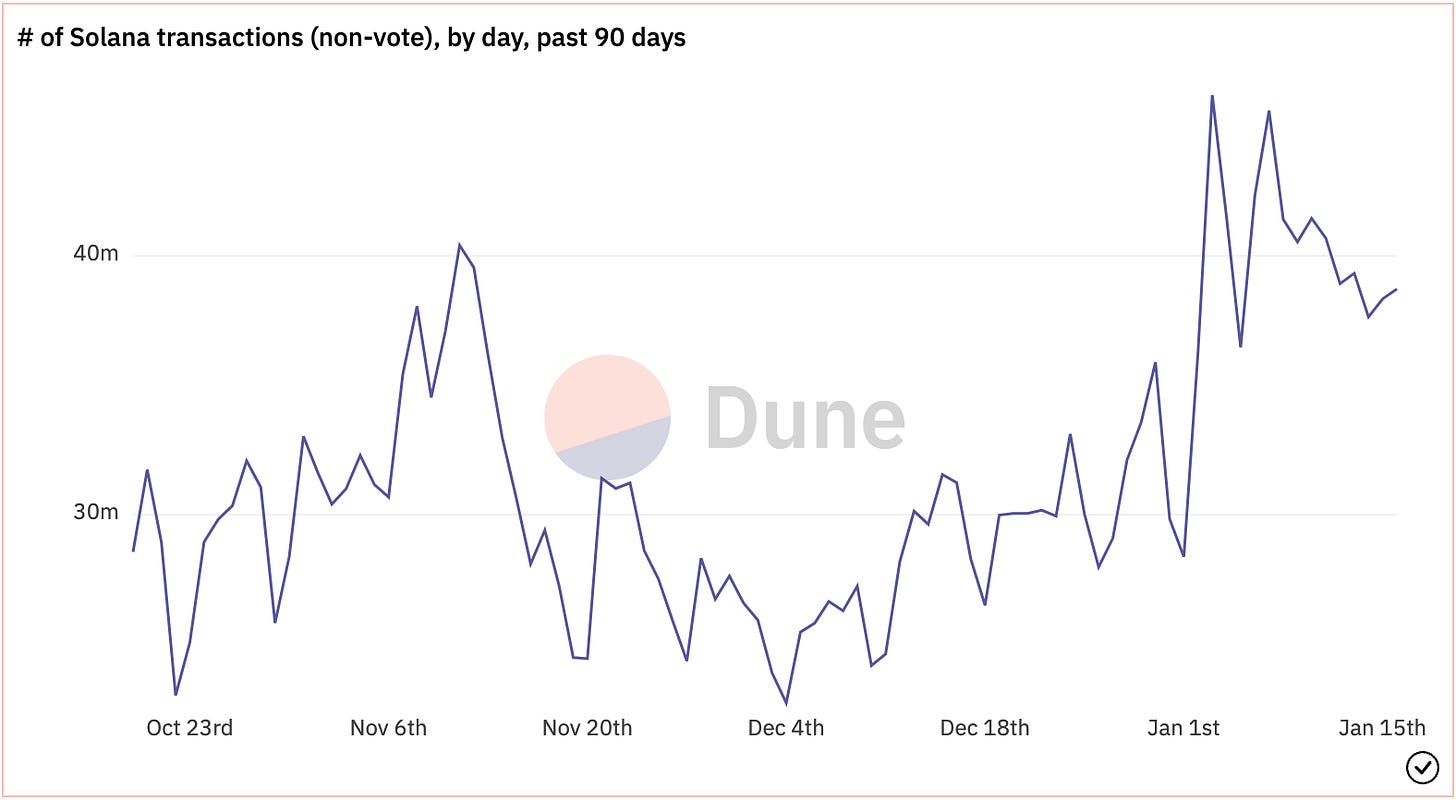

Solana goes BRRR

The number of Solana transactions recently spiked:

Usage on the chain can also be shown by DEX daily active users that swap to perform other activities like staking, lending, and liquidity provision.

Solana's total TVL has also experienced a mild spike:

🧪 Yield Farming 101

Simple ETH auto-compounding strategy

Step 1: Deposit ETH into rETH/ETH pool on Balancer

Step 2: Deposit rETH back into the Balancer pool

Step 3: Swap BAL for ETH

Step 4: stake ETH for frxETH on Frax Finance

Risks:

-Smart contract risk from interacting with multiple protocols

-Rocket pool liquid staking risk

-Frax ETH liquid staking risk

Thena fi, Liquid Driver, and the cross-chain flywheel

Liquid Driver and Thena’s partnership is a testament to the synergy of the DeFi space. LiquidDriver is the first liquidity mining dApp providing liquidity-as-a-service on Fantom, and Thena is a newly launched AMM on the Binance Smart chain (BSC), innovating liquidity provision through a demand-driven emissions model. This partnership allows liquidity providers access to boosted pools courtesy of Liquid Driver. Additionally, both protocols benefit from their shared liquidity and the unified flywheel effect their systems create.

Here’s how this partnership works:

What is Thena?

To understand the significance of the partnership, you must understand how Thena works. Thena is an Automated Market Maker (AMM) with a tokenomics structure seeking to empower the most efficient protocols on BSC through its unique Voter Escrow (VE) token model.

Simply put, AMMs are a type of decentralized exchange (DEX) that use algorithms to allow users to trade crypto with lower slippage. Additionally, AMMs allow users —Liquidity providers (LP)— to offer up their liquidity for specific token pairs to earn yields from emissions and fees. Currently, pools are incentivized with scheduled farming emissions, and because of this, liquidity providers are not driven by fee generation.

Thena fixes this issue with its demand-driven model.

Thena’s liquidity provision model takes from Curve’s model—incentivizing token locking for VE tokens that grant voting power over gauges and protocol fee yields— and the Olympus model — provides a “rebase mechanism” that helps to shield token lockers from dilution. Unlike Curve, Thena does not allow boosting APYs for individuals, instead, veTHE holders increase the APY for all liquidity providers.

On top of its blended liquidity provision model, Thena is also a hybrid AMM— combining the style of vAMMs with sAMMs. Being a hybrid AMM allows for more efficient routing between assets. The sAMM style ensures that users experience lower price impact and tighter spreads on stablecoin swaps or closely aligned assets. The vAMM model optimizes for users trading volatile assets.

veTHE

Thena’s token $THE complements Thena’s unique AMM model and is an essential part of its flywheel effect.

$THE can be locked on Thena’s platform for veTHE which does two things: (1) remove $THE from circulation, increasing demand in the market, and (2) grant gauge voting, bribes, revenue share, and governance rights to veTHE holders.

Breakdown:

(1) In order to acquire veTHE, you must first lock your $THE on Thena’s platform

(2) veTHE holders can vote on gauges (pools) to direct $THE emissions —increasing yields for farmers that provide liquidity to those pools—, receive yields from Thena’s revenue share, bribes, and vote on Thena protocol changes with veTHE’s governance power.

To ensure the best protocols are incentivizing liquidity, Thena airdropped 17% of the total $THE supply, as veTHE to a group of ‘partner’ protocols. This airdrop allowed Protocols to tailor their own strategies to maximize the value extracted from Thena.

Thena’s structure allows protocols to take part in Thena’s flywheel through liquidity mining strategies. Specifically, Protocol-owned liquidity (POL) and Bribes are two of Thena features that enable these strategies.

POL

Protocol-owned liquidity (POL) involves protocols with veTHE positions that choose to deploy their own liquidity into their pools on THENA in order to farm $THE. Protocols then lock the earned $THE as veTHE and increase their share of the veTHE total supply.

Bribes

Bribing refers to protocols depositing extra rewards on their gauge on Thena to incentivize veTHE holders to vote for their pool. Those rewards are claimed by veTHE holders that vote and allocate $THE emissions to specific pools.

When combined together, POL and Bribes can increase power over THENA’s emissions long-term.

Liquid Driver —participation in Thena flywheel

As one of Thena’s launch partners, LiquidDriver received a veTHE airdrop. LiquidDriver launched pools on Thena: BNB-LQDR, and OATH-LQDR, where users can farm $THE. This is a part of Liquid Driver’s veTHE acquisition strategy: LiquidDriver will incentivize $LQDR liquidity on THENA through bribes, then, it will use its POL to yield $THE rewards from its farms that will be locked and compounded into more veTHE to boost potential yields further. Once LiquidDriver becomes a top veTHE holder, it will gradually allocate the farming rewards toward its xLQDR revenue-sharing vault.

Liquid Driver also opened some farms including $BTC-$BNB, $ETH-$BNB, and $BUSD-$BNB, where users can create LPs on Thena and deposit them on the LiquidDriver to earn boosted yields in $LQDR.

liveTHE— liquid drivers flywheel

LiquidDriver is extending this flywheel one step further with its intricate token-wrapping system. Essentially, Liquid Driver is creating a liquid staking derivative of veTHE called “liveTHE.” liveTHE will be a way for people to benefit from bribes/fees (minus a performance fee) without having to lock anything up.

As of now, liveTHE is in production, and as Dr. Liquid (LiquidDriver’s CEO) develops this strategy, there will be more updates from the LiquidDriver team gradually.

If you’d like to learn more about LiquidDriver, read this thread:

If you’d like to learn more about wrapped liquid staking derivatives, read this thread:

🐦 Last Week in Crypto Twitter (CT):

Tweets & Narration provided by @BrokeDegenFAFz

New protocol that is ran by the GMX blueberry club! Sounds like donkey finance or SFTX:

An analysis on Uni V3 LPing and protocols that make it easier:

Important developments from Dopex:

jUSDC looks to be an interesting product. There is a WL opportunity for alpha/beta testing. If you get in, let me know how it works!

Top alpha tweets of last week

Okay this one is insane. Up and coming projects on Arbitrum. Some you know, some you don’t.

DeFi Mochi, the wizard of Dune, brings us dashboards to help us analyze Layer 2’s, the Victor in the category, and various metrics used to analyze their success.

A list of resources Linn uses to track all of the things and make it easier to get ahead of the game.

🗞 Latest News

Russia and Iran explore launch of joint cryptocurrency backed by gold

Polygon Announces Proposed Hardfork To Improve Chain Performance

For more information visit DefiCryptoVaults.com