DeFi Vaults Issue #49

DeFi Market Research | profitable ETH-USDC LP via Lifinity, Analyzing Arbitrum’s Post-Airdrop Performance, Liquid Staking Rates Rise, and More | NFA

⚡️What’s new?⚡️

🏦 This Week’s DeFi Vaults: Liquid staked vaults, and stablecoins

🧪 Yield Farming 101: Profitable ETH-USDC LP via Lifinity

📊Charts & Stats: Arbitrum’s Post-airdrop Performance

🐦 Last Week in Crypto Twitter (CT): How to research & interpret fee revenue, Macro thoughts from BrokeDegen , Analyzing Arbitrum whales, and more

🏦 This Week’s DeFi Vaults

Liquid Staked Vaults

sFTMx — ~6.5% ⬆️ (Reaper.Farm)

wMATIC-MATICx LP — ~8.24% ⬆️ (Balancer)

mSOL — ~6.75% ⬆️ (Marinade.Finance)

sAVAX— ~7.2% (BENQI)

frxETH— ~5.6% (Frax Finance)

Stablecoin Vaults

Ethereum

$MAI/$DAI/$USDC/$USDT — ~8.8% (BeefyFinance)

$USDT — ~ 8.45% (IronBank)

$MAI/$USDC — ~ 9% ⬇️ (BeefyFinance)

$DAI— ~ 7% ⬇️ (IronBank)

$DAI— ~ 8% (Yearn)

Fantom

$BUSD/$USDC— ~9% (BeefyFinance)

$USDC — ~5.46% (BeefyFinance)

$MAI/$fUSDT/$USDC — ~12% ⬆️ (BeefyFinance)

$fUSDT/$USDC — ~6.2% (BeefyFinance)

$USDC — ~11% (TarotFinance)

$USDC — ~12% (TarotFinance) | Equalizer V2 USDC/FTM

$MAI— ~15% (TarotFinance) | Spookyswap USDC/MAI

$USDC/$MAI — ~5% ⬇️ (ReaperFarm)

Liquid Driver Shadow Farms

$fUSDT/$USDC — ~22% ⬇️ (LiquidDriver)

$DAI/$USDC — ~15% (LiquidDriver)

$MIM/$USDC — ~27% (LiquidDriver)

Polygon

$USDC/$MAI —~23% ⬇️ (KyberSwap)

$DAI/$USDT —~10% (KyberSwap)

$jEUR/$PAR— ~11% ⬇️ (BeefyFinance)

$MAI/$USDC — 11% (BeefyFinance)

$DAI (gDAI vault) — 10% (GainsNetwork)

Solana

$USDH — ~69% ⬆️(HubbleProtocol)

$USDC — ~7% (SolendFi) | Nazare Stablecoin Pool

Optimism

$USDC/$USDT — ~16% (KyberSwap)

$USDC/$MAI — ~28% (KyberSwap)

$USDT/$DAI — ~14%⬆️ (KyberSwap)

$MIM/$USDC — ~10% (BeefyFinance)

$LUSD/$USDC — ~10% (BeefyFinance)

$MAI/$LUSD — ~10% (BeefyFinance)

$LUSD/$DAI — ~12% ⬇️(BeefyFinance)

$jEUR/$MAI— ~16% ⬇️ (BeefyFinance)

$agEUR/$MAI— ~26% ⬇️(BeefyFinance)

$MAI/$USDC— ~13% ⬇️ (BeefyFinance)

$jEUR/$sEUR— ~11% ⬇️ (BeefyFinance)

$agEUR/$USDC — ~26% ⬇️(BeefyFinance)

Reaper.farm Sonne Vaults

$USDT — ~6% (ReaperFarm)

$USDC — ~4% (ReaperFarm)

$DAI — ~5% (ReaperFarm)

Avalanche

$MAI/$USDC— ~10.65% ⬆️ (Beefy.Finance)

$USDT — ~12% (IronBank)

$DAI.e — ~9% ⬆️ (IronBank)

$USDT/USDC — ~13% ⬇️(TraderJoe)

$USDT.e/$USDT — ~10% ⬇️ (TraderJoe)

$DAI.e/USDC — ~10.4% (TraderJoe)

Arbitrum

$LUSD/$USDC— ~10% (BeefyFinance)

$LUSD/$USDT— ~13% ⬇️(BeefyFinance)

$agEUR/$USDC— ~24% ⬇️ (BeefyFinance)

$jEUR/$USDC— ~20% (BeefyFinance)

$MAI/$USDC— ~10% ⬇️ (BeefyFinance)

$MAI/$USDC— ~12% (BeefyFinance)

$MAI/$gDAI— ~20% (BeefyFinance)

$MIM/$USDC/$USDT— ~9% (BeefyFinance)

$MAI/$USDC— ~23% ⬇️(KyberSwap)

$DAI (gDAI vault) — 12.3% (Gains Network)

🧪 Yield Farming 101

ETH-USDC LP via Lifinity

ETH-USDC —34% APY

Here’s the alpha:

Lifinity, a Solana PMM, makes a profit through market-making which covers, and in some cases reverses, impermanent loss in liquidity pools (LPs).

The ETH-USDC LP will give you exposure to both ETH and USDC while allowing you to proportionally earn on both assets.

As shown below, the ETH-USDC Lifinity LP accrued 35% more value than if you were holding ETH and USDC in your wallet.

How is this possible?

Intro to Lifinity

Many people steer away from NON-STABLE-STABLE LPs, and for good reason; often times the pool experiences impermanent loss incurring a net loss for the user.

Lifinity, a next-gen DEX, fixes this and achieves capital efficiency through the use of the proactive market maker (PMM) model.

Proactive Market Makers (PMMs)

The first decentralized trading model was the automated market maker (AMM), which uses Constant Product Market Maker (CPMM) model (x*y=k) where x represents the first token in the pair, y represents the second token, and k represents the constant. This formula —crowned by Uniswap— matches orders and rebalances the pool. Lifiinty iterates on the AMM algorithm by leveraging the value of k by multiplying x and y by L —the amount of leverage.

Proactive market makers (PMMs) like Lifinity solve the shortcomings of AMMs and provide a higher level of capital efficiency —PMMs are 500% more capital efficient than AMMs. Capital efficiency refers to the amount of liquidity provided vs. the total volume the pool can facilitate. For instance, a pool with $500,000 on Lifinity can facilitate a trading volume of $1.6M weekly, giving it a capital efficiency of 101.68%.

Under the hood, Lifinity’s PMM is supported by:

Concentrated liquidity

Oracles

A rebalancing mechanism

Market Making Profit

Market making allows Lifinity to buy low and sell high, instead of relying on arbitragers. Lifinity can generate more yield compared to other AMMs. Long-term collective gains from market-making are usually greater than the impermanent loss suffered by the pool.

📊Charts & Stats

Arbitrum’s Post-airdrop Performance

Arbitrum airdropped the long-awaited $ARB token to early users, and the network performance has fared very well.

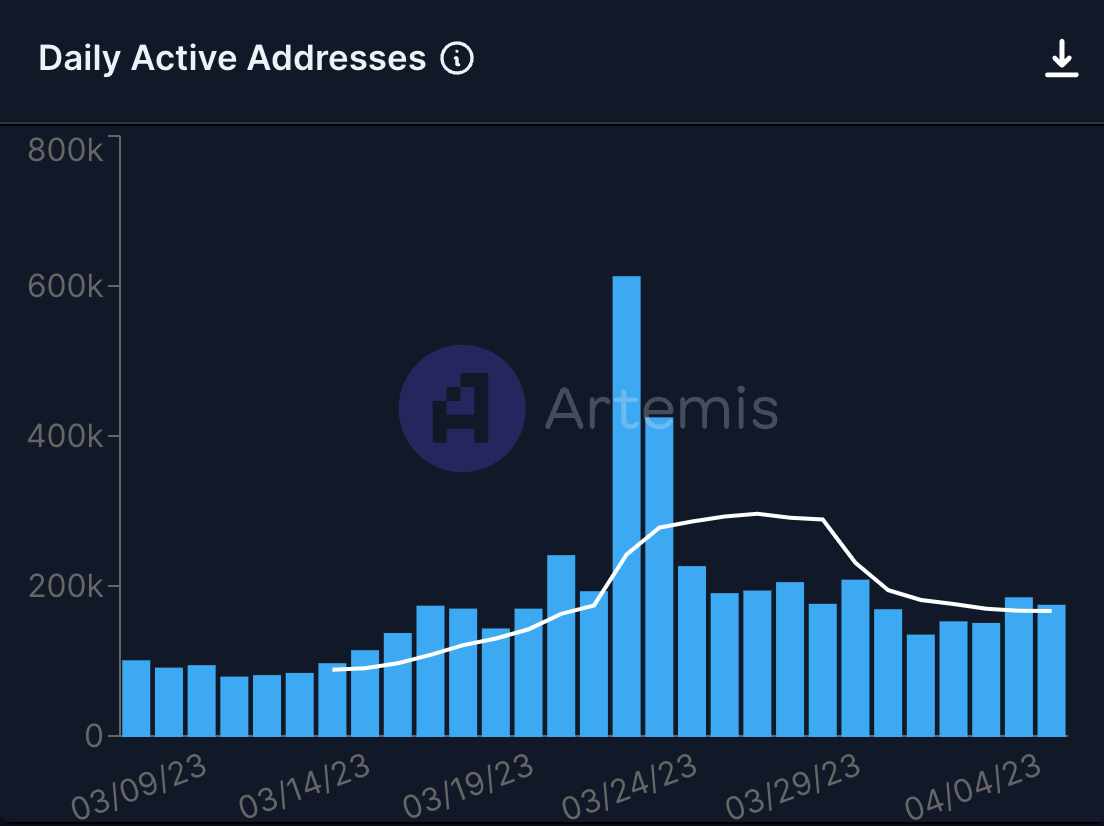

As expected, daily active users spiked on the day of the airdrop (March 23rd), rising 250%, as many users interacted on-chain to claim their airdrops. After the airdrop, daily active users are down 71%, but they have slightly increased from the number of users on-chain pre-airdrop:

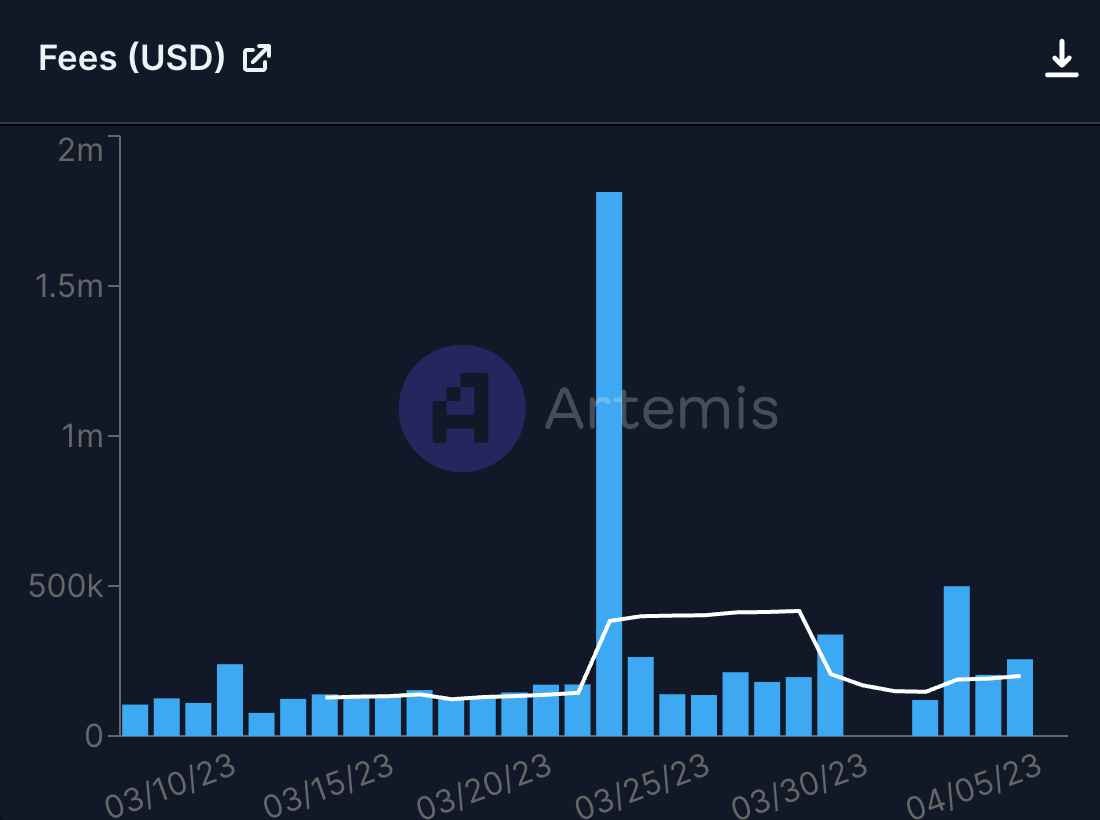

Fee’s show a similar story, as they spiked on the day of the airdrop:

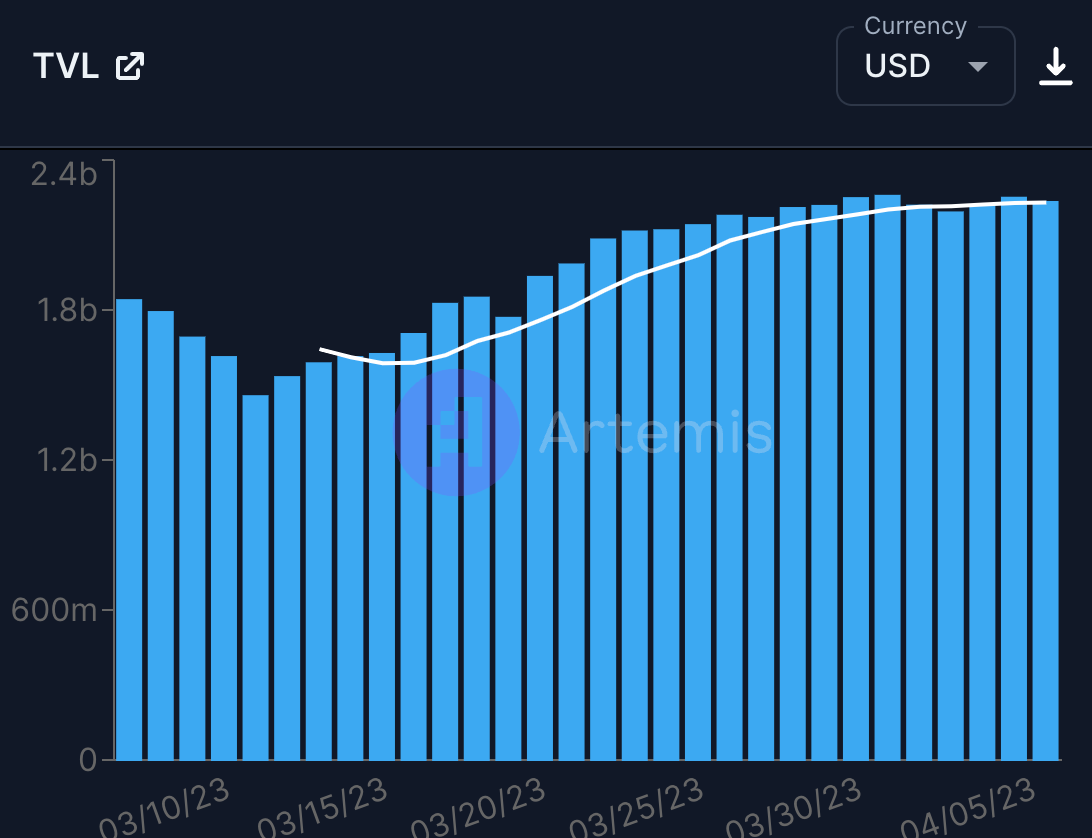

This is where it gets interesting. TVL rose on the chain as expected, but it continued steadily to increase and is now up 10% since the day of the airdrop:

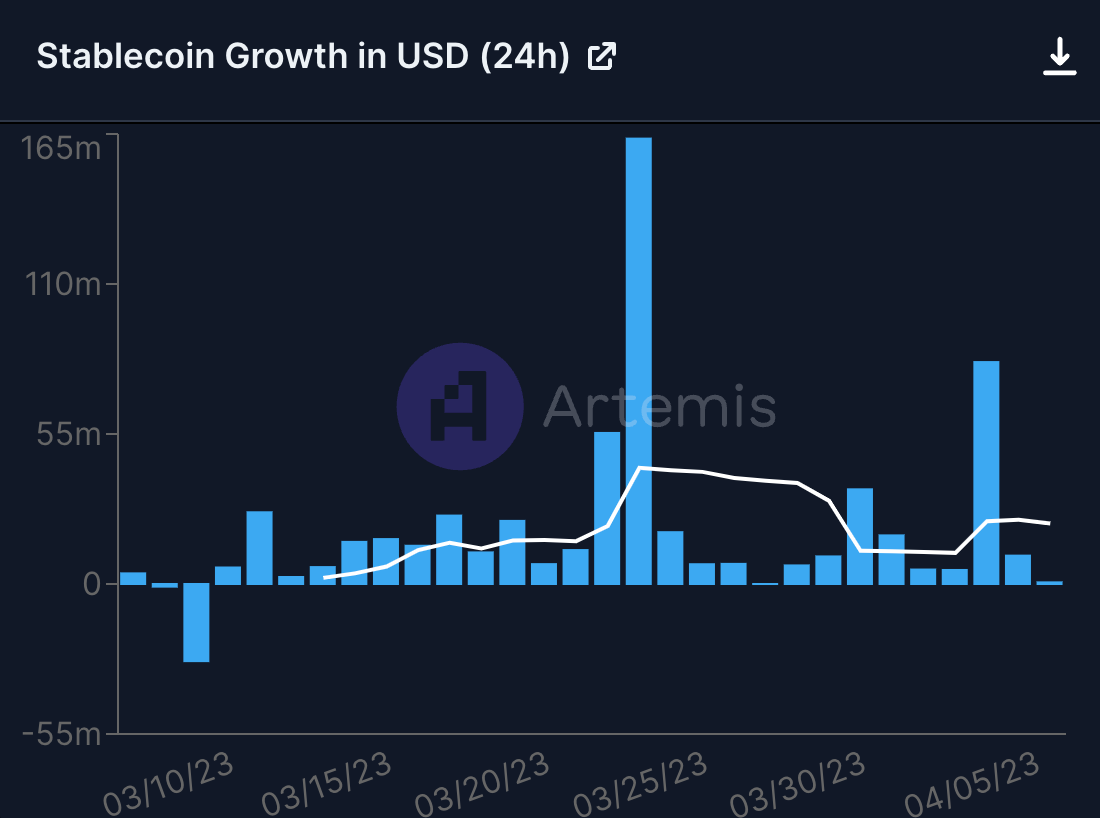

A similar story is shown in stablecoin growth:

And, stablecoin market cap:

Takeaways:

Arbitrum is continuing its stellar performance from the last quarter.

Keep an eye out for new composable protocols launching on Arbitrum that allow users to earn greater yield!

🐦 Last Week in Crypto Twitter (CT)

Tweets & Narration provided by @BrokeDegenFAFz

Data coming out this week that is significant:

How to properly research fee revenue:

Arbitrum Foundation’s response to AIP-1:

Video on the Scroll airdrop farming method:

On the macro side of things, Saudi Arabia is lowering its oil output by 1.65 million barrels per day. This was not only unexpected but also regarded as an asshole move. In addition, apparently, the Chinese Yuan is now the most traded currency in Russia. The shift from the USD is beginning now

Rektiomedes has become an ambassador of something called SilentDAO, so naturally, I went to check it out. Here’s an article explaining what they are building and it is pretty cool:

Which whales own which Arbitrum ecosystem tokens?

An overview of Pancake Swap V3:

Apparently, the BD guy at Spooky Swap either found or created a stablecoin protocol on Fantom:

To learn more, visit Deficryptovaults.com