DeFi Vaults Issue #73

Zero-liquidation-loans (Everything you need to know), Mantle USDT/wETH Yield Farming Strategy, and More.

What’s new?️

🏦 DeFi Vaults: This Week’s Top LST and Stablecoin Vaults

📚 DeFi deep-dive: An Introduction to Zero-liquidation-loans via MYSO Finance

🗣 Industry Interview: AMA With Full-stack Developer From MYSO Finance

💸 Yield Farming 101: Mantle USDT/wETH Strategy

🐦 Last Week in Crypto Twitter (CT): BNBChain AMA, Solana Hyperdrive Hackathon Spotlight, EURC Yield Strategy, and More.

🏦 DeFi Vaults

Liquid Staked Tokens

MATICx LP - 4% (StaderLabs)

mSOL - 8% (Marinade.Finance)

sAVAX - 5.8% (BENQI)

frxETH - ~3.15% (Frax Finance)

ETH+ - 3% (Reserve Protocol)

Stablecoin Yields List

Ethereum

$eUSD+FRAX/USDC - 8.97% APY (CurveFinance)

$hyUSD/$eUSD - 11.4% APY (CurveFinance)

$MIM/$DAI/$USDC/$USDT - 12.7% APY (BeefyFinance)

$R-DAI -16.25% APY(BeefyFinance)$USDT - 24% APY (IronBank)

Polygon

$DAI (gDAI vault) - 10.3% APY (GainsNetwork)

$jEUR/$PAR - 9.4% APY (BeefyFinance)

Optimism

$USDC (hot tub) - 9% APY (Perp Protocol)

$jEUR/$PAR - 9.4% APY (BeefyFinance)

$LUSD/$DAI - 6.3% APY (BeefyFinance)

$LUSD/$USDC - 6.7% APY (BeefyFinance)

$LUSD/$USDT - 8.8% APY (BeefyFinance)

Arbitrum

$DAI (gDAI vault) - 10.7% APY (GainsNetwork)

$agEUR/$USDC.e - 6.60% APY (BeefyFinance)

$DAI - 4.9% APY (BeefyFinance)

$MIM/$USDC.e/$USDT - 9.5% APY (BeefyFinance)

zkSync

$USDC/$LUSD - ~30% APR (MaverickProtocol)

USD+/USDC - 30% APR (PancakeSwap)

BUSD/USDT - 31% APR (PancakeSwap)

USDT/USDC - 10% APR (PancakeSwap)

BUSD/USDC - 12% APR (PancakeSwap)

📚 DeFi deep-dive

An Introduction to Zero-liquidation-loans via MYSO Finance

TL;DR

MYSO Finance provides access to Zero-liquidation-loans (ZLLs)

LPs/Lenders provide liquidity, and borrowers access loans in a Peer-to-peer (P2P) market:

When the loan is repaid = Perfect scenario (borrower has accessed zero-liquidation loan and the lender gets paid from interest payment(s))

If the loan is defaulted = the LP/Lender takes on collateral

MYSO v2 is live on Ethereum, Arbitrum, and Mantle.

What is MYSO?

MYSO is a lending market standing at the forefront of zero-liquidation loans, a groundbreaking concept that offers borrowers protection against liquidation while rewarding lenders with enhanced yields in exchange for assuming extra risk.

MYSO strives to offer borrowers capital-efficient, liquidation-free loan options while simultaneously providing opportunities for Liquidity Providers (LPs) to boost their yields. Let's take a deep dive into how MYSO distinguishes itself from conventional crypto lending markets in achieving these goals.

How Do Traditional Crypto Lending Markets Work?

In traditional lending markets, Lenders deposit their assets into smart contracts, and borrowers can then request loans by providing collateral. Smart contracts automatically determine loan terms and interest rates.

Borrowers must closely watch their Loan-to-value (LTV), to ensure they are not liquidated. LTV represents the proportion of a loan amount in relation to the value of the asset used as collateral. Liquidations occur when the collateral that borrowers pledge suddenly drops in value causing the borrowed asset to surpass the set LTV.

For example, if you want to borrow USDC using 1 ETH (valued at $1,700) as collateral, and the vault allows for an 80% LTV, you can borrow a total of $1,360 USDC. However, if you borrow all $1,360 of available capital and the price of 1 ETH drops you will be liquidated, even if the price moves up again afterward. In addition, borrowers will be charged a fee every time a liquidation happens.

How Do Zero-Liquidation-Loans (ZLL) Work?

Lenders

In traditional finance (TradFi) terms, becoming a lender on MYSO essentially provides exposure to an in-the-money covered call.

Relating it back to DeFi, lenders on MYSO provide liquidity for loans (to receive interest payments), but if the provided collateral depreciates, borrowers will be less incentivized to repay the loan (to retrieve collateral), which will leave the lender with the defaulted collateral.

In a perfect scenario, once a loan has been repaid, LPs can claim their share of the corresponding repayment. LPs also have the ability to remove liquidity that hasn’t (yet) been lent to borrowers to mitigate risk.

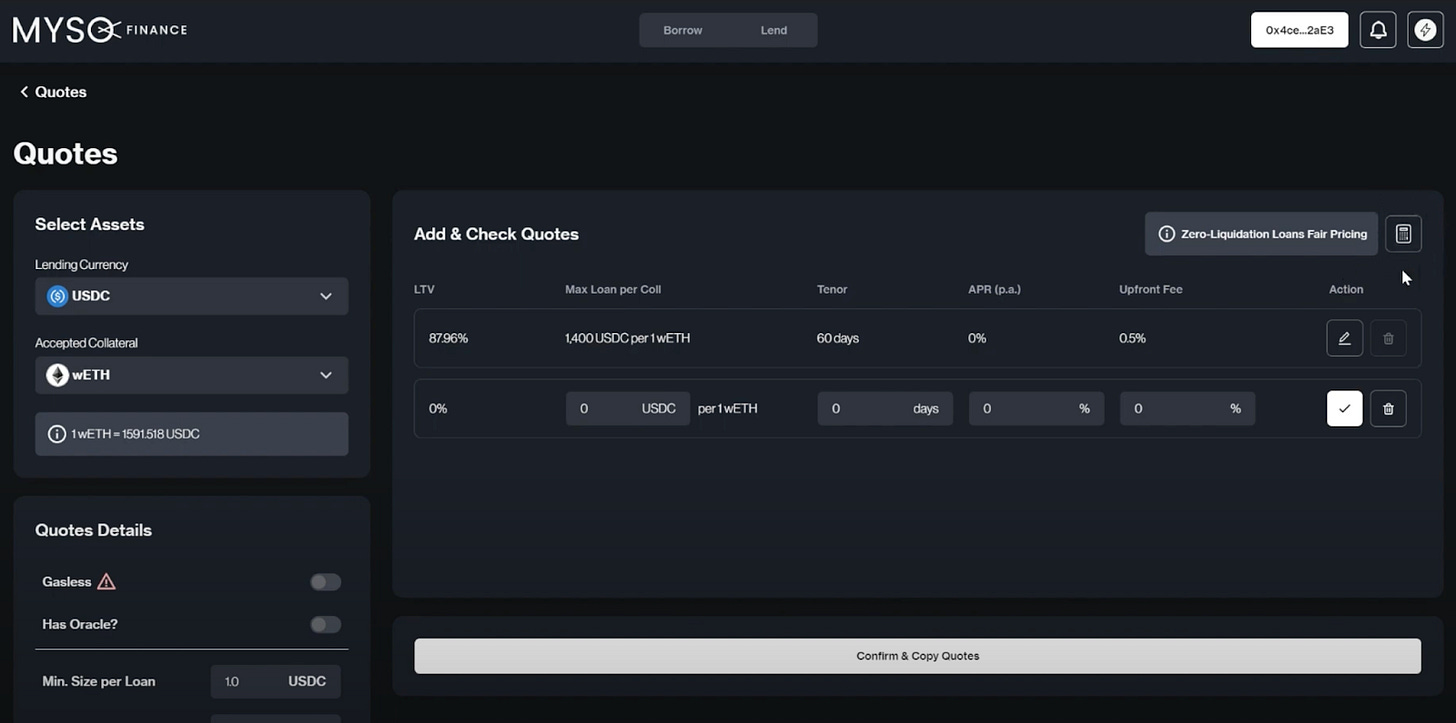

When a user creates a new permissionless pool, they start by setting the accepted collateral/loan pair (e.g., wETH/USDC). For each liquidity pool, a user can set multiple loan quotes. Setting loan quotes requires you to set the following parameters:

The duration of the loan (loan length).

The maximum amount of loan currency that can be borrowed per pledged collateral.

The interest rate.

The upfront fee.

Every pool created will be independent and separate from one another, differing from the common shared-pool approach used by many traditional lending protocols.

Risks of Lending

The introduction of MYSO v2 removed a lot of the potential risk taken on by LPs/Lenders, yet there are still some main risks to be aware of:

Collateral price risk: If, during the loan period, the value of the collateral used to secure the loan drops below the amount the borrower owes, the borrower likely won't repay the loan. In such a situation, Liquidity Providers (LPs) will receive the defaulted collateral, which has lost value.

Non-transferability of LP position: LP positions are non-transferable, meaning that the only way to recoup a liquidity contribution is by removing any unused liquidity and claiming from all entitled loan proceeds.

Opportunity costs: When an LP deposits funds into a pool, it's impossible to predict exactly when the next borrower will come in and when the LP's funds will be used to finance the next loan.

Borrowers

Borrowers can choose the pool that best matches their preferred collateral and loan currency combination, loan tenor, etc.

From the borrower’s perspective, removing liquidations eliminates one of the biggest friction points of current crypto loan offerings, where users typically have to constantly monitor their health factors and liquidation thresholds.

Once a borrower has taken out a loan they can either (a) repay and reclaim their collateral or (b) let the loan expire. In either case, the corresponding loan is then marked as settled and the associated proceeds are made available to LPs.

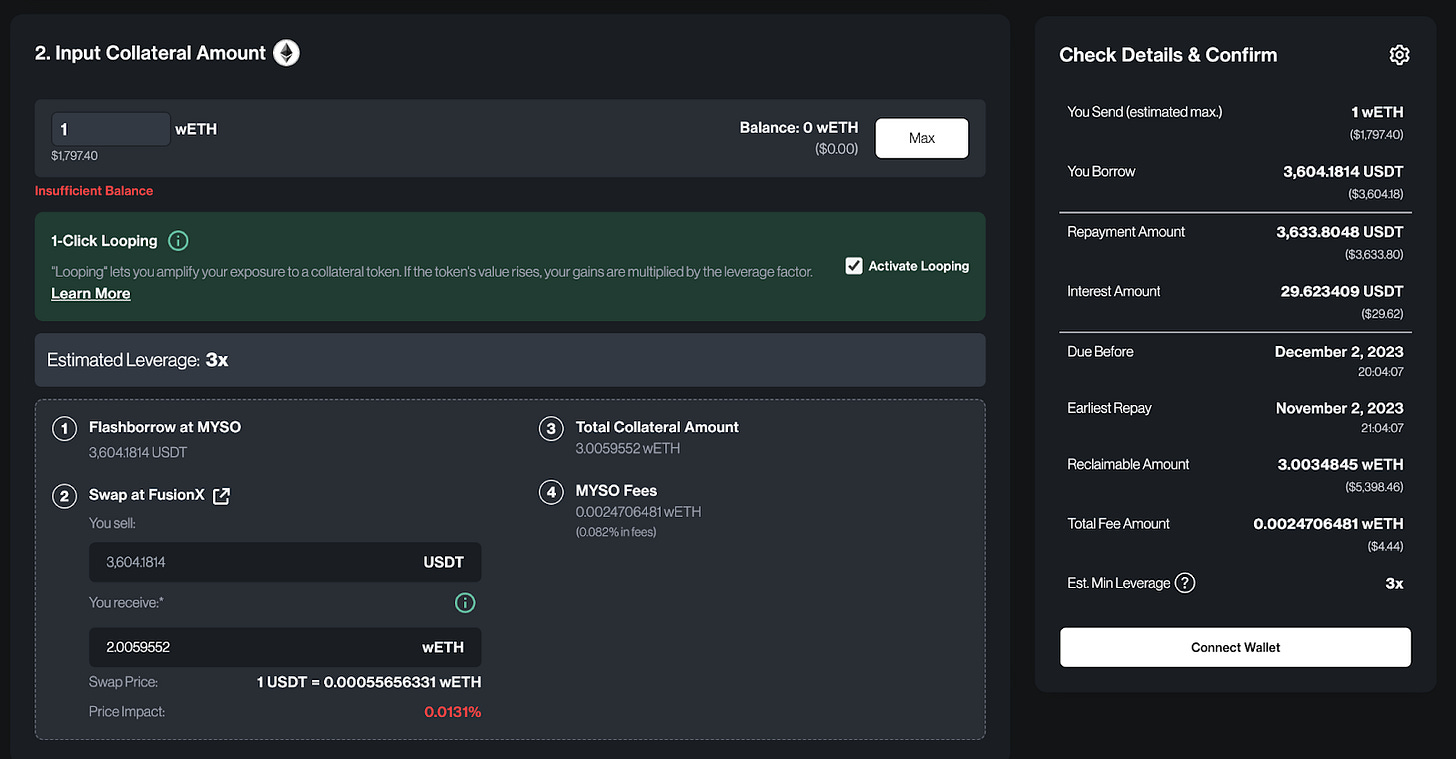

1-click Looping

In traditional crypto lending markets, looping refers to the cycle of lending collateral, borrowing a different token, exchanging this borrowed token for your original collateral on a decentralized exchange (DEX), and then repeatedly lending it within the same lending pool.

MYSO has revolutionized this process, offering borrowers the ability to efficiently leverage their exposure to their collateral token with a simple, one-click action. This empowers borrowers to gain leverage and significantly expand their access to capital.

For a detailed understanding of how 1-click looping operates, you can refer to this article by the MYSO team: Article.

Conclusion

Zero-liquidation loans offer a convenient way for borrowers to avoid constantly monitoring their Loan-to-Value (LTV) ratios and the need to protect themselves against potential penalties for liquidation. The risk of loan liquidation shifts from the borrower to the lender (in a peer-to-peer market) and the lender is rewarded with yields for taking on this risk.

With zero-liquidation loans, borrowers can keep their collateral holdings unchanged and steer clear of any liquidation charges. Additionally, borrowers can still enjoy the full benefits of their assets' value appreciation and only need to repay the initially borrowed amount or the value of their pledged collateral, whichever is lower.

MYSO Finance

Website: https://www.myso.finance/

Twitter: https://twitter.com/MysoFinance

🗣 Interview with Jameson Pickett, Lead Full Stack Developer, MYSO Finance

Last week I had the opportunity to sit down with Jameson Pickett, Lead Full Stack Developer from MYSO Finance, and pick his brain about the protocol. We discussed his views on DeFi, the next steps for the protocol, and he also dropped some alpha at the end!

Question #1: What considerations do you make when launching on a new blockchain?

🗣Jameson:

There are multiple considerations we make when launching on a new chain, but I would say what we consider are a few factors (by no means a comprehensive list):

i) EVM compatibility

ii) deFi liquidity and current deFi integrations

iii) opportunities for establishing Myso as a leader on that chain in some area or niche

iv) strong eco fund support

v) user requests

Question #2: What have been your biggest takeaways from working on the MYSO team or in DeFi in general?

🗣Jameson:

Having been in crypto working full-time for almost 3 years and having been a founding member of Myso nearly 2 years ago, I still am challenged at the pace of developments, trends, and cycles in the space. Being a stratup in any fintech/tech area is frenetic, but in crypto it seems like that is turbocharged! The Myso team, though, has been great and so much fun to work with. We are always staying positive and looking to adapt to our user needs in face of any challenges.

Question #3: How do you ensure the security of users' funds on MYSO?

🗣Jameson:

Great question here! We have a few ways that we ensure security of user funds.

The most obvious point is (multiple) audits by expert teams where they devote significant resources and time to test our protocol. We have 3 audits by Trail of Bits, Omniscia, and Statemind and these were typically multi-week, multi-dev endeavors (for instance, statemind audit was around 6 weeks auditor time). In addition, we have our own thorough test suite and contracts publicly available to aid users while they do research on Myso.After that, we have our bug report/bounty system, and we also utilize OpenZeppelin Defender monitoring of our system looking for odd or malicious activity. There were also key design decisions made from the outset that mitigate risks, such as lender vaults that are isolated and prevent contagion, and no ability for protocol to prevent vault withdrawals or force defaults (though protocol can prevent future borrowing if needed, it cannot lock past transactions or user funds in a vault).

I want to be clear, no honest protocol can ever say that they have eliminated smart contract risk, but we do think we have done and will continue to do everything possible to mitigate that risk.

Question #4: How do you see the future of DeFi lending apps evolving, and what are your plans for the continued development of MYSO?

🗣Jameson:

As more players enter the space over time, for instance more funds and institutions, one of our these is that in addition to the current lending pooled approaches, more bespoke and efficient lending needs will arise. This is one area that is a huge focus of Myso, the ability to scale our with ease bespoke terms across a wide variety of assets, tenors, risk tolerances, collateralization ratios, fees and APR structures et al, with minimal cost and overhead. This is what we are currently focused on building out in our UI/UX for a seamless borrow and lender experience.

Question #5: Have you considered adding capabilities for applicable lenders to provide incentivization/farming rewards for borrowers? or anything of that nature?

🗣Jameson:

Absolutely! In fact, we have hooks available to make this trustless and seamless where the lender or a third party or the Myso protocol itself could add rewards for borrowers, but this is still a work in progress, but coming soon in conjunction with our TGE!

Question #6: What's next for MYSO, integrations, token integrations etc.?

🗣Jameson:

Next for Myso is to help build our [protocol] on arbitrum since we just launched there, including collateral support of GLP tokens, Pendle, and other interesting projects. The great thing about our optional-oracle, no liquidation design is whitelisting new tokens is typically very simple compared to most other lending protocols, so we look forward to integrating many tokens, really only limited by user demand and imagination! In fact, our RFQ bot has a place where users can inquire for new tokens and we will be happy to review and integrate quickly. Plus our TGE will be coming soon! Stay tuned for more updates there.

💸 Yield Farming 101

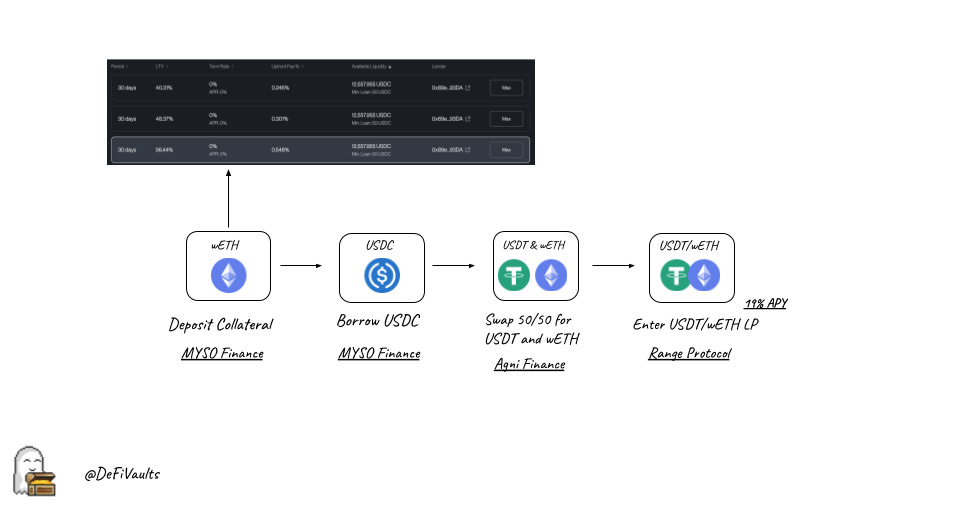

Mantle USDT/wETH strategy

Strategy:

Network: Mantle

Yield Farming strategy for a sideways market where you want to keep your ETH safe long-term.

Provide wETH (to the USDT/wETH pool) as collateral on MYSO

Borrow USDC (0.5% wETH fee)

Swap USDC 50/50 for USDT/wETH

Provide liquidity to USDT/wETH on Range (19% APY)

Exit the pool and swap back to USDC

Repay loan

Buyback wETH (lost from loan fee) and keep additional USDC

Risks:

LP price risk

Smart Contract risk from depositing into multiple protocols (MYSO and Range Protocol)

🐦 Last Week in Crypto Twitter (CT)

BNBChain AMA with DeFi Ignas:

Solana Hyperdrive Hackathon Winner’s Spotlight:

Tsunami Finance Partners with Layer2 Index

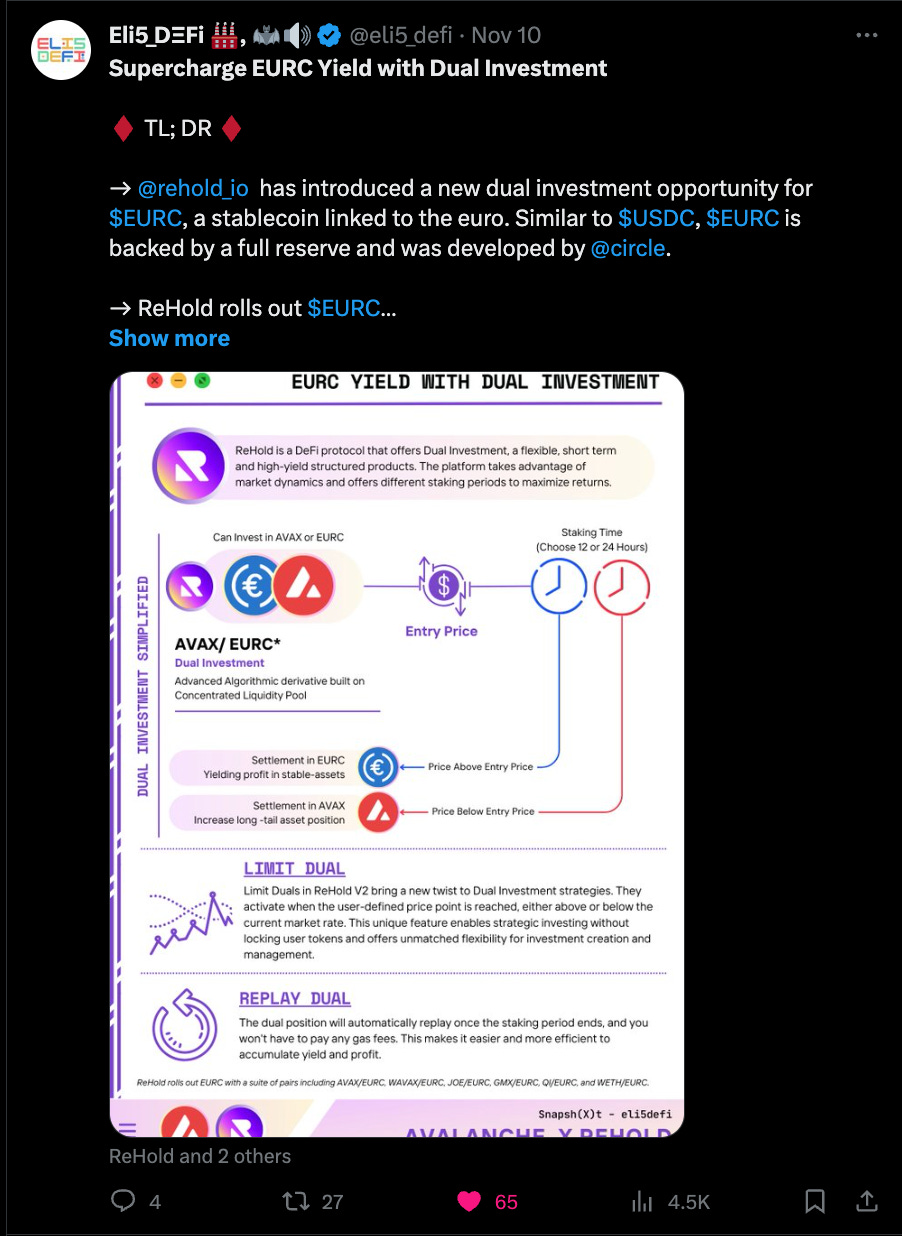

EURC yield strategy provided by Eli5 DeFi:

That's all for this issue of DeFi Vaults, stay up on your research, and happy farming! 👩🌾