DeFi Vaults Issue #78

DeFi Market Research | Exploring DeFi's Top Narratives by TVL, Base Stablecoin's (Avg. 44% APY), Thala Labs Deep-dive, Amplifi protocol, and more!

🏦 This Week’s DeFi Vaults

📊 Charts & Stats: Exploring DeFi’s Top Narratives

📱Amplifi Protocol

📖Deep Dive: Thala Labs, The Driving Force Behind Aptos

🐦 Last Week in Crypto Twitter (CT): Andre Cronje teases new FTM exclusive protocols, Perpetual Protocol V3 Beta, Aptos Galaxe Campaign #3 (airdrop), and more

🏦 DeFi Vaults

Spotlight: Base avg. stablecoin apy = 44% 🔥

Liquid Staked Tokens

MATICx LP - 5.4% (StaderLabs)

mSOL - 7.18% (Marinade.Finance)

sAVAX - 5.8% (BENQI)

frxETH - ~3.8% (Frax Finance)

ETH+ - 3.18% (Reserve Protocol)

Stablecoin Yields List

Polygon

$DAI (gDAI vault) - 13.2% APY (GainsNetwork)

$jEUR/$PAR - 10.2% APY (BeefyFinance)

$USDC - 7.37% (BeefyFinance)

Optimism

$USDC (hot tub) - 16% APY (Perp Protocol)

$jEUR/$agEUR - 14.2% APY (BeefyFinance)

$LUSD/$DAI - 6.46% APY (BeefyFinance)

$LUSD/$USDC - 30% APY (BeefyFinance)

$LUSD/$USDT - 38% APY (BeefyFinance)

Arbitrum

$DAI (gDAI vault) - 12.5% APY (GainsNetwork)

$gDAI - 33.7% APY (BeefyFinance)

$USDC.e/$USDT - 12.6% APY (BeefyFinance)

$DAI - 7.85% APY (BeefyFinance)

$MIM/$USDC.e/$USDT - 35.40% APY (BeefyFinance)

$crvUSD/$MIM - 39% APY (BeefyFinance)

zkSync

BUSD/USDT - 42% APR (PancakeSwap)

USDT/USDC - 20.2% APR (PancakeSwap)

BUSD/USDC - 34.15% APR (PancakeSwap)

Solana

USDH/USDC - 15.68% APR (Hawksight)

USDC/USDT - 4.89% APR (Hawksight)

USDC/USDT - 4.16% APR (Hawksight)

UXD/USDC - 16.67% APR (Hawksight)

Base

$hyUSD/$eUSD - 51.99% APR (BeefyFinance)

$USDC/$eUSD - 50.10% APR (BeefyFinance)

$USDC/$MAI - 76.54% APR (BeefyFinance)

$eUSD/$crvUSD - 16.85% APR (BeefyFinance)

$MAI/$USDCb - 29.20% APR (BeefyFinance)

📊 Charts & Stats

Exploring Crypto’s Top Narratives

TL;DR:

From January 25th, 2023, to January 25th, 2024, DeFi TVL increased 16.8% from $47.47b to $55.49b. Here’s what else took place in one year:

Dexes experienced a 21.9% decrease in TVL, falling from $18.12b to $14.1b (~25.4% of DeFi’s TVL).

Liquid Staking TVL increased 188.1% from $10.93b to $31.25b, overtaking Bridges, CDPs, Lending, and Dexes.

Liquid Staking accounts for 56.8% of DeFi TVL.

RWAs experienced a 555% increase in TVL.

TRON is the 2nd largest blockchain with a TVL of $7.71b (behind Ethereum)

The Services category overtook Yield for the 6th spot, growing ~14% from $4.61b to $5.24b.

To date, the top 5 narratives in DeFi by TVL are Liquid Staking, Lending, Dexes, Bridge, and CDP.

As new dApps and primitives are being introduced to the market, new narratives are gaining market share. To give you an idea of the changing landscape, here is a list of the top narratives on January 25th, 2023, by TVL:

Dexes - $18.12b

Lending - $13.52b

CDP (stablecoins) - $9.68b

Liquid Staking - $10.93b

Bridge - $9.29b

Yield - $5.85b

Dexes held the majority of the market share at $18.12b TVL, holding ~38% of the total DeFi TVL ($47.47b). Its closest competitor was lending markets, which held $13.52b TVL (26.7% of DeFi’s TVL).

Since this time last year, many of the top categories have swapped places. Though the top 5 narratives have more or less stayed the same, there were some pretty interesting movements between the categories, to say the least.

For reference, here are the top narratives by TVL as of today (January 25th, 2024):

Liquid Staking - $31.52b (+188.1% ) up 3 positions

Lending - $21.01b (+55.39%) same position

Dexes - $14.14b ( -21.96%) down 2 positions

Bridge - $13.31b (+41.3%) up 1 position

CDP (stablecoins) - $9.39b (-2.9%) down 2 positions

Services - $5.26b (+14%)

Let’s take a closer look at some of the narratives with the most interesting growth (and losses):

Liquid Staking

Liquid Staking has taken over the DeFi market, and for good reason. Having the ability to earn native yields on L1 tokens to beat inflation is a killer use case.

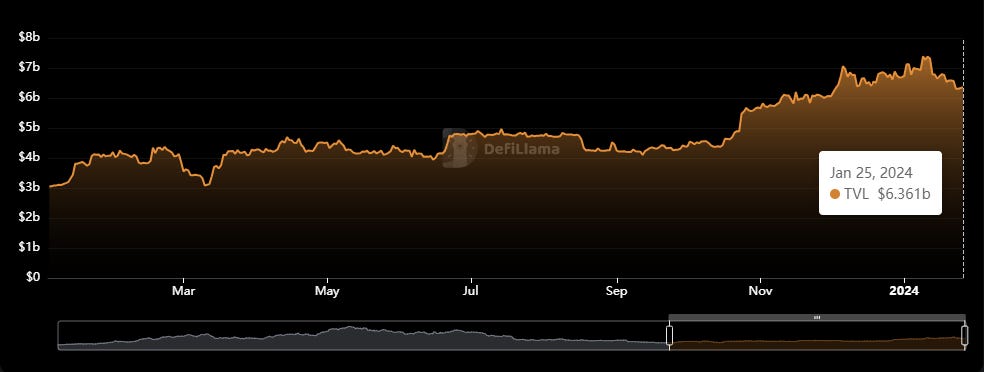

The category currently boasts $31.52b TVL, accounting for 56.8% of DeFi TVL. What’s even more impressive is that it grew 188% over a year!

This massive growth can be attributed to Lido, which grew 155% from $8.21b TVL (Jan. 25th, 2023) to $20.98b TVL (Jan. 25th, 2024). The Liquid Staking Derivative giant is currently active on 5 chains and offers 2 LSDs including stETH, and stMATIC.

Other top Liquid Staking protocols include:

Rocket Pool

Binance Staked ETH

Mantle Staked ETH

Lending

Lending grew from $13.52b to $21.01b, achieving a ~55% increase in TVL in one year. This growth allowed it to maintain its #2 position among the top DeFi narratives.

Lending gives users the ability to collateralize their holdings, and long and short assets among other strategies.

There’s no telling what exactly led to the growth of lending markets, but here’s one likely scenario: As DeFi TVL and asset prices increased, users were looking for a place to leverage their assets without forgoing the positive price action (by collateralizing their assets, and borrowing stables). If that’s the case, it would create an opportunity for risk-averse users to capitalize on the heightened stablecoin deposit rates created by the borrowers.

Additionally, Lending protocols accept LSDs and RWAs (more on those later) as collateral, which allows them to feed off of some of the other top narratives.

Regardless of what led to the increase in lending TVL, the top 2 players contributing to this growth were AAVE and JustLend:

AAVE is DeFi’s largest lending protocol

JustLend is the leading lending protocol on TRON

Bridges

Crypto Bridges facilitate the cross-chain movement of assets. With bridges, users send assets from one chain to another, receiving a wrapped version of their asset on the destination chain.

The main contributors to the Bridge sector growth were WBTC and JustCryptos:

WBTC is wrapped Bitcoin issued from Bitcoin. WBTC’s growth can be attributed to the rise in the price of BTC as well as BTCs growing popularity.

JustCryptos is TRON’s bridge for assets including BTC, ETH, LTC, and DOGE. JustCryptos’ growth can be attributed to the rise in the price of accepted assets as well as the TRON blockchain’s growing popularity.

Dexes

Dexes lost ~25% of TVL, and it’s due in large part to Curve. Once a DeFi giant, Curve’s TVL has gradually been on the decline since 2022. Over the last year, Curve lost 59% of its TVL, dropping from $4.76b to $1.94b.

RWA

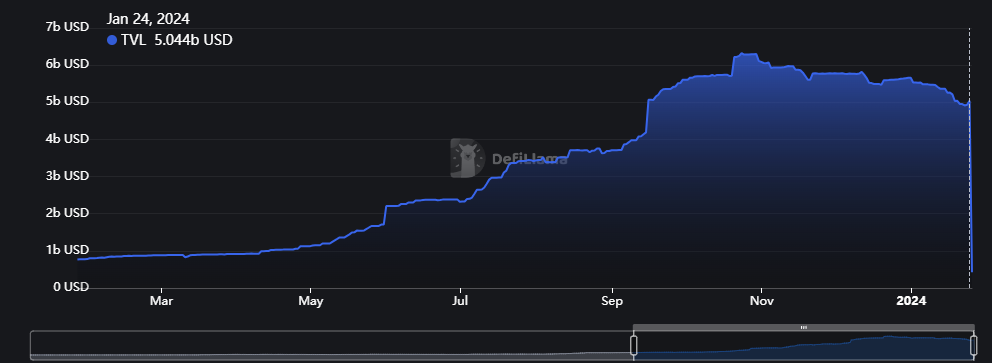

Though RWA is not within the top 5 DeFi narratives by TVL, yet, they have achieved remarkable growth of 555% (from $768.94m to $5.044b) and are on pace to move up a couple of positions as the year progresses.

RWAs leverage real-world assets like T-bills, and real estate and collateralize them, to bring the wealth on-chain. This makes them a great option for users looking for the best of TradFi and DeFi.

The top protocol’s in RWAs are Maker, and stUSDT:

Conclusion

There are many conclusions to be drawn from this analysis, but here are my top 3:

Liquid Staking and Lending are emerging as the top narratives in DeFi, as shown by TVL growth.

Interestingly enough, three of the top protocols of the top sectors (lending, bridges, and RWAs) happen to be dApps native to TRON, which include:

JustLend (Lending)

JustCryptos (Bridge)

stUSDT

Though Dexes are essential to every ecosystem, users are choosing not to LP and deposit funds (but still perform swaps).

Although users are depositing funds to Dexes at a lower rate than other sectors this provides the perfect opportunity to earn yields. Hear me out, if fewer people are depositing to Dexes, yet more people are swapping, that means Dex fees aren’t as diluted as before. This means you can LP into pools with highly correlated volatile assets are stables and get the yields others are leaving on the table!

📱’Services’ DeFi Narrative: Amplifi Protocol

The services category consists mainly of dApps that leverage DeFi yields and products, offering it to users in productized ‘vaults’. Having experienced a 14% increase in TVL and currently holding the #6 spot in narratives, Service dApps are on the rise!

One Service dApp I’m bullish on is Amplifi!

Amplifi is still in Beta, but it presents an interesting concept of leveraging AI/ML-driven decision-making to optimize yields and automate risk prevention. Amplifi is also using account abstraction to simplify the onboarding process for users while allowing them full custody of funds.

Amplifi also presents another opportunity for airdrops! Users that participate in the Zealy quest, and complete tasks including signing up for the waiting list and following Amplifi on Twitter, are eligible for an airdrop.

When Amplifi opens up for deposits, I will write a review detailing its offerings and my experience!

Links:

📖Deep Dive

Thala Labs, The Driving Force Behind Aptos

I teamed up with to write about Thala Labs, Aptos’ top buildoors

TL;DR:

Thala Labs accounts for ~70% of Aptos’ TVL

Thala Labs has developed foundational dApps including:

ThalaSwap - DEX

Move Dollar (MOD) - CDP Stablecoin

ThalaLaunch - Decentralized Launchpad

Parliament - DAO Governance Platform

thAPT - Aptos Liquid Staking Derivative

THL - Governance token

Developer Ecosystem Initiatives

Thala Foundry (Aptos Incubator)

Open-Source tools

With the wide range of products in the Thala Labs suite, we believe the team has the potential to become the largest native DeFi Lab on the Aptos network.

Read the full write-up

🐦 Last Week in Crypto Twitter (CT)

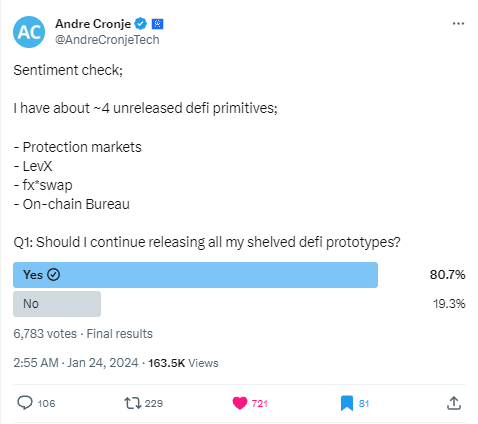

Creator of Yearn, and driving force behind Fantom, Andre Cronje, creates Twitter poll to gauge sentiment on releasing new Fantom exclusive primitives:

Perpetual Protocol announces Beta launch for Perp V3!:

Tensor releases new ‘price lock’ feature:

Reserve Protocol announces 4 new initiatives:

Fantom Meme-coin tools:

Picnic V2 is here!:

TUSD depegs:

Aptos Galaxe Campaign #3. If you want to find out why Aptos is a top-notch ecosystem/L1 and qualify for an airdrop in the process, join this quest!:

That's all for this issue of DeFi Vaults, stay up on your research, and happy farming! 👩🌾